Valuing a tech company today has to be done much differently than five or ten years ago.

In the old days (like 5 or 10 years ago) tech companies were more often valued using old economy methods. These were usually multiples of key financial metrics like profit, revenue and growth rate.

This article was written by our Emeritus Founder almost a decade ago. It’s a good description of how tech company valuation was done then and is still an essential read for anyone wanting to understand the foundation of current day valuation methods.

The most important take away from the post below is the effect of growth rate on valuation: THIS HAS NOT CHANGED in the new economy.

Business Valuation- What Will Your Company Sell For?

BY BASIL PETERS

My bookshelf has an entire section of books on valuation. Even though I deal with valuation every day, I haven’t looked at any of those books for at least a couple of years. It’s just not a process you need reference books for. Most of the time, acquisition valuations can even be done without a spreadsheet – many professionals will work out the valuation on a whiteboard or even a post-it-note.

That sounds simple, but valuation is actually quite challenging. One reason is because it’s based on the ‘type’ of company and the ‘quality’ of earnings. Growth rate, predictability and market conditions are also significant, but difficult to quantify, inputs to the valuation process.

MARKET CONDITIONS

Valuation depends significantly on market conditions. Changes in valuation can occur because certain types of companies are in greater demand, or because some sectors are perceived to be more attractive by acquiring companies.

For example, in the past few years, SaaS (software-as-a-service) companies have been in high demand. Companies like Yahoo, Google, Cisco and others bid up the prices for these types of companies because they wanted to buy them faster than entrepreneurs could add to the supply.

As a result, it’s been both relatively easy, and relatively lucrative, to sell SaaS companies recently. In earlier times, online storage, online advertising and blogging platform companies have all had valuation peaks as demand grew faster than supply, or as those sectors were perceived to be ‘hot.’

VALUATION PRINCIPLES

That said, the basic mechanics of valuation are straightforward. In financial terms, the value of any business is the present value of the future income stream the company will generate. The present value calculation factors in the ‘discount’ that someone would pay today for a stream of income in the future.

For example, let’s imagine a company that generates $1 million in profit every year. A $1 million profit next year is worth pretty close to $1 million today because you’d only have to wait a year to get it. If you could get an ‘interest rate’ of 18% per year, then you’d value $1,000,000 in a year at around $820,000 today (i.e., its present value). In other words, the ‘discount’ in this example would be 18%.

But $1 million of income ten years from now is worth considerably less. If it’s almost certain that the $1 million would actually be there in ten years, then the discount is pretty close to the interest rate that you could earn on the money over the ten year period.

For example, Figure 1 shows the present value if the interest, or discount, rate was 18% and the company generated $1 million in profit for the next ten years and then shut down. In this case the value is a little less than $ 4 million – or a P/E ratio of about four.

| Zero Growth |

Profit in the year |

Present value of this year’s profit |

| End of this year |

$1,000,000 |

$820,000 |

| End of next year |

$1,000,000 |

$672,400 |

| Three years from now |

$1,000,000 |

$551,368 |

| Four years from now |

$1,000,000 |

$452,122 |

| Five years from now |

$1,000,000 |

$370,740 |

| Six years from now |

$1,000,000 |

$304,007 |

| Seven years from now |

$1,000,000 |

$249,285 |

| Eight years from now |

$1,000,000 |

$204,414 |

| Nine years from now |

$1,000,000 |

$167,620 |

| Ten years from now |

$1,000,000 |

$137,448 |

| Total Present Value |

$3,929,403 |

Table 1. Simple valuation model with zero growth

Unfortunately, in real world situations, it’s never quite that simple.

The first complication is that companies are either growing or contracting. So if the income from a company was $1 million last year, the only thing you can be sure of is that it’s not going to be $1 million again next year.

Companies with high growth rates are worth much more than companies that are growing more slowly. If the discount rate is still 18%, but the company’s profits are growing at 25% per year for ten years, the numbers will look like those in Table 2.

| 25% Growth |

Profit in the year |

Present value of this year’s profit |

| End of this year |

$1,000,000 |

$820,000 |

| End of next year |

$1,250,000 |

$840,500 |

| Three years from now |

$1,562,500 |

$861,513 |

| Four years from now |

$1,953,125 |

$883,050 |

| Five years from now |

$2,441,406 |

$905,127 |

| Six years from now |

$3,051,758 |

$927,755 |

| Seven years from now |

$3,814,697 |

$950,949 |

| Eight years from now |

$4,768,372 |

$974,722 |

| Nine years from now |

$5,960,464 |

$999,090 |

| Ten years from now |

$7,450,581 |

$1,024,068 |

| Total Present Value |

$9,186,773 |

Table 2. Simple valuation model with 25% growth

In this case, the present value of a company with $1 million in profit this year, but a 25% growth rate, is actually worth over $9 million, or more than double the example with no growth. In this case, the price earnings multiple, or P/E ratio, is about 9.

Note to Math Purists: These present value calculations are simplified to make them easier to follow. If you use the Net Present Value (NPV) formula in Excel, the numbers will be slightly different.

GROWTH AND VALUATION

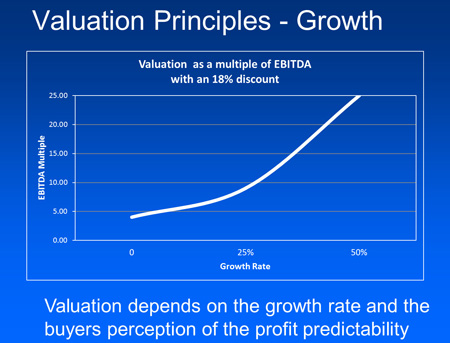

This graph shows how the valuation in the example above changes for different growth rates.

The dramatic increase in valuation as growth rates approach 50% per year are a good way to understand why some high growth tech companies are acquired for very high valuations.

PREDICTABILITY

Another significant, and difficult to quantify, factor in company valuation is predictability. Even if a company has been growing at 25% per year for the past several years, there is no way to be sure this growth rate will continue. The management team may be confident that the growth rate will be even higher in the future—and may say so enthusiastically to potential acquirers. However, the buyers will be skeptical – and one can’t blame them for being concerned that the growth rate might decline in the future.

This uncertainty in the future projections creates another type of discount factor on the valuation. The predictability discount becomes very subjective, and everyone involved in a transaction will have a different perception of what the fair predictability discount should be. For mature stable companies, it might not be a very significant part of the valuation calculation. In valuations of technology companies, especially young ones, this factor can create an enormous divergence in the perception of the fair value.

CUSTOMER CONCENTRATION

Customer concentration is a good example of something that affects predictability. Most valuations implicitly assume a diverse customer base. But when one customer starts to account for more than 10% of revenue, the valuation will be negatively affected because the risk that the large customer might leave becomes significant to the future earnings of the company. In situations where a single customer accounts for over half of the revenue, the fair company valuation might be reduced by as much as 80 to 90%. In these situations, agreement on prices requires the buyer and seller to reach agreement on the probability that the large customer will continue for a considerable length of time. This can be a challenge even if binding long term contracts are in place.

BEFORE PROFITABILITY

Valuation gets even more interesting when the company and its business model have yet to be proven in the market long enough to establish profitability margins. A large percentage of the companies that are sold in the technology area have yet to reach profitability at all, or are growing too quickly to generate any significant profit.

Agreeing on valuation requires the buyer and seller to have a common view about what the profit margins are likely to be in the future and how fast they will grow. It’s easy to see how the difficulty in predicting these future financials can lead to wide variations in what different people think is the fair value.

PRE-REVENUE COMPANIES

At the very earliest stages, companies may not even have revenue. In these cases they are being sold entirely for the perceived future value of their intellectual property (IP). A good case study for this type of exit transaction is Brightside, a Vancouver company that developed technology to increase the brightness of large liquid crystal displays.

In this case, the company had effectively zero revenues, but was nevertheless sold to Dolby Labs for $28 million in cash. This was entirely based on Dolby’s belief that the company’s patents and IP would enable them to build a future stream of licensing revenues that would more than justify the $28 million purchase price.

Another example is the $30 million exit of Pacinian. That company was also pre-revenue.

There are a couple of models to value pre-revenue companies but they really aren’t very useful. Pre-revenue valuation is much more of an art than a science. The best way to determine a current, fair value is to find someone with the experience, and current knowledge of your market, to give you a number.

COMPARABLES

In practice, the challenges of developing even limited consensus around a company’s future growth rate, profit margins and predictability often make the whole financial model exercise too challenging to be useful. As a result, most of the time, both buyers and sellers resort to much simpler math based on comparables.

Comparables are used every day by professional analysts who work for stock brokerage firms. The analysts’ job is to examine individual companies and then put their current valuation in perspective by comparing them to similar companies. Through analyses like these, it’s possible to generate broadly applicable rules of thumb, or multiples, to value similar companies. The most common multiples for tech companies are price to earnings ratios (P/E) and price to sales ratios (PSR).

One factor to keep in mind is the “discount for illiquidity”. The well accepted rule is that a private company’s value is about 30% less than an identical public company. This difference is primarily due to the fact that the private company’s shares cannot be resold in the public market – in other words because it is illiquid.

TYPES OF COMPANIES

Mature companies, with low growth rates, can be fairly valued at P/E multiples of four to five, or a PSR of one (depending on their growth rate and profitability).

For younger companies, earnings are often non-existent or extremely volatile. In these situations, most valuations are based, at least in part, on multiples of revenue. For example, these days software-as-a-service companies are regularly valued in the three to four times revenue range (PSR = 3 to 4). This relatively high revenue multiple is thought to be reasonable because these companies have a high percentage of recurring revenue and good margins. It is also believed that market growth will enable these companies to grow faster than other tech companies.

On the other end of the spectrum are service companies that are essentially ‘body shops.’ These companies can only grow as fast as new employees can become productive. Typical examples are web design firms, management consultants and human resource companies. These types of companies are often valued at PSRs of 0.5 or P/E multiples as low as two or three. This is also partly because the revenue predictability of these types of companies is low and because they usually have small percentages of recurring revenue.

OTHER MULTIPLES AND FACTORS

Every industry, and every type of company, also has its unique multiples based on key performance indicators (KPIs) applicable to that industry. For example, with Web 2.0 companies, some analysts reference the company price to the number of unique visitors per month, and multiples based on Alexa rank. Almost any metric can be used to build a valuation model.

If you wanted to get an idea of what your company is worth, you could read some valuation books and then do some online research and try to do a valuation yourself. This is not usually very satisfying because most of today’s smaller transactions are not even announced, and the ones that are rarely disclose enough information to be a useful comparable. You also need a lot of experience, and a good feel for the current market, before you can do any type of useful valuation.

PLEASE DON’T PAY FOR A FORMAL VALUATION

Another common mistake is to pay for a formal valuation, and then believe this valuation will be useful in negotiating an exit transaction. There is a large industry that does business valuations. Some of the reasons companies pay to get valuations done are for tax reasons, public financing or divorces.

Those valuations are usually ten or twenty pages long, cost tens of thousands, and include lots of spreadsheets and comparables. In my experience, those types of valuation can show an extremely wide range of values. In my opinion, they are not usually accurate enough to be used even in a discussion around an exit transaction. (Apologies to my friends in the industry who do valuations – most of you know exactly what I mean.)

THE BEST WAY TO GET A VALUATION FOR YOUR COMPANY

The easiest, and most accurate, way to get an idea of what your company might be worth if you sold it today is to find an M&A advisor who has been doing exit transactions for similar companies. You’ll need to share some of your financials so they can use the applicable multiples to give you a first pass estimate of your company’s value. If you can find two or three real professionals, who understand your type of business, they will probably all give you valuations that agree within 20 to 30%.

As a final note, the price achieved on the sale of a company can be significantly skewed by the quality of the exit design and execution. This is especially true in transactions under $20 million because these are often young companies with little history. The markets for these types of companies are very inefficient.

These companies can also have a much broader range of potential strategic values for different acquirers. With these smaller transactions, the skill of the M&A advisor has a much larger effect than it would in the sale of a large established company with predictable profit margins and growth rates. A very skilled M&A advisor can often get a small company sold for 50% more than the same company would sell for with an average M&A advisor.

If you have questions about your valuation, please contact us here.