Early-stage tech companies can succeed for a period of time driven by the talents of the founders and small investments from family, friends and angel investors. At some point, however, the company grows to a size where management processes must become more formalized and many decisions will need to be delegated to avoid the chaos created by a small group of founders making all of the decisions. What got them to this point won’t get them to the next point without changing the management process: Larry Greiner’s landmark article captures the challenge in his brilliant article: “Evolution and Revolution as Companies Grow”. It is as true today as when it was written several decades ago.

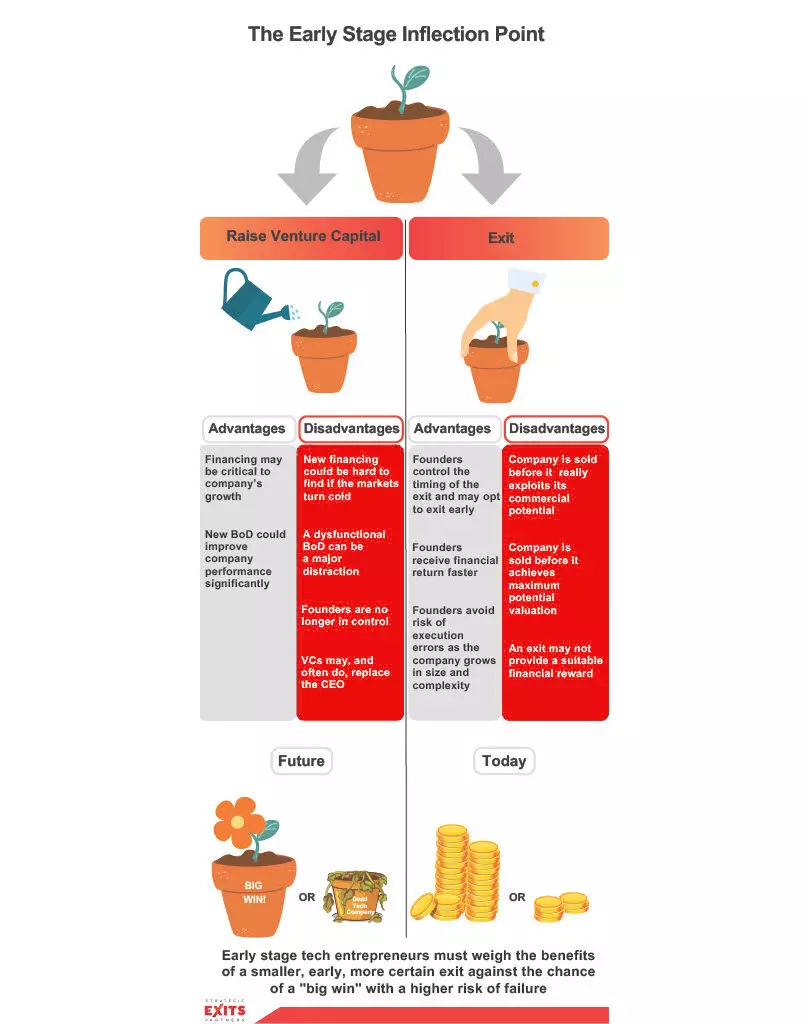

The need to formalize management often coincides with the need to raise financing to fuel the company’s continued growth. At this point the founders are at an inflection point where they must choose one of two distinct paths:

- Raise a Series A round of venture capital

- Sell the company

Let’s examine the pro’s and con’s of each path.

Venture Capital route:

Pro: Raising venture capital provides the financing that the company needs to grow. Provided the company continues to grow and met its targets, in warm or hot financial markets, the company can usually raise subsequent rounds of Series B and C financing with the assistance of the VC.

Con: When the financial markets turn cold, as they are at the time of writing in Q1 2023, new financing may become very hard to find. Venture Capitalists become much more judicious in their investments. Diligence is longer and deeper and the financial cycle stretches out. VCs often restrict new financing to companies in their portfolio to their top tier of companies most likely to succeed while the others are left out in the cold. Unfunded companies must swiftly change their strategy from growth to survival. (See the companion Article: The Tech Sector is in a Downturn – What Should Tech Entrepreneurs Do?

Having chosen the VC route, tech entrepreneurs are implicitly accepting this risk.

Pro: The venture capitalists may become heavily involved in the management of the company. This is often a good thing because VCs are smart and experienced and can advise the company on the many decisions they have to make.

Pro: The investors will require the formation of a Board of Directors to oversee the decisions and actions of management. This is a positive development because an experienced and active board can significantly improve the performance of the company. The Directors can lend their expertise and help an inexperienced CEO avoid mistaken decisions and actions.

Con: Inexperienced or inattentive Directors can be more trouble than they are worth. At a minimum, a poorly functioning Board can be a major distraction to the founder, and at worst, can crater the company.

Con: The investment of venture capital brings with it major changes to the operation of the company:

The founders are no longer solely in control. While the influx of VC and Director experience should be good for the company and shareholders, it may be difficult for many entrepreneurs to shift their focus from the freedom to create new things, to the less-exciting challenges of management. Many founders vacate the role of CEO at this point and take a position as Chief Development Officer or similar role, or leave the company entirely.

Con: One negative aspect of a VC investment is becoming better understood. In accepting a VC investment, the founders relinquish control of several important matters. Venture capital investors require their investment to be in a separate class of Preferred shares which have specific rights. The incorporation documents will be amended to require approval of all classes of shares on the issuance of new shares (i.e.: new financings). All classes of shares must agree before any sale of shares which would cause a change in control (i.e., an exit.) Effectively, through their ownership of a class of Preferred shares, the VCs hold a veto on financings and exits regardless of the percentage of shares which they own.

Other preferred rights often include the ability to hire and fire the CEO, which is responsibility usually reserved for the Board.

Con: There is also the “swing for the fences” approach that many venture capitalists bring. Since they manage a portfolio of investments, they can afford to have a few failures as long as they get a couple of big wins. The often means pushing their companies to grow as quickly as possible. But some companies reach their peak valuation before the VC is ready to sell. They may be pushed to achieve impossible results, and ultimately fail. As long as a few companies are successful, they pay for the rest which fail. Economically, that may work, but it can be quite hard on the founders of the companies that didn’t make it.

Early Exit route:

By choosing an early exit, the founders are opting to sell the company early; long before it reaches its peak. This route also has its pro’s and con’s:

Pro: Founders retain control of the decision on when to exit. Often, they will opt to exit early rather than raise a Series A round,

Pro: The Founders receive a financial return several years earlier than by becoming an investment in a VC’s portfolio.

Pro: The Founders avoid the considerable risk of execution errors as the company grows in size and complexity.

Con: The company is sold before it achieves its technical and commercial potential.

Pro or Con? The economics might not support a VC financing. Apart from the risk of execution errors that come with growth, even a successful exit might not be that financially rewarding. Accepting investment means diluting the founder’s ownership and delaying an exit for several years. Founders may want to do a Return on Investment calculation. It may show that discounting the future exit using a rate reflecting the significant risk over the additional years to get there yields a lower ROI than exiting the company before taking the investment, even if the actual dollars are smaller. https://www.exits.partners/2022/11/20/introduction-to-early-exits-2-0/

Considering the risks and opportunities, the founder may elect to exit early, before taking on external investment. This consideration is discussed at length in the book: Early Exits https://www.amazon.com/Early-Exits-Strategies-Entrepreneurs-Capitalists/dp/0981185517