Valuation

Valuation

BY David Rowat

Note: there is a 16 minute video at the bottom of this post which summarizes the main points. UPDATE Previous versions of this article described a valuation process for SaaS companies that relied on the Annual Recurring Revenue (ARR) times a Revenue Multiple adjusted for the characteristics of the specific SaaS company. This current update in January 2024 improves on previous versions in two ways: first...

Valuation

BY David Rowat

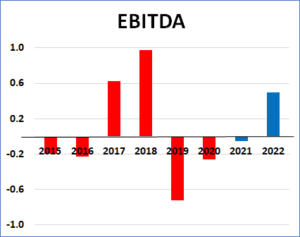

This article discusses the popular business valuation methodologies for valuing tech companies: Discounted Cash Flow EBITDA times Multiple Revenue times Multiple Discounted Cash Flow (DCF) approach DCF is the time-honoured approach which you can find in every textbook on valuation. It is the most credible for matur...

Valuation

BY David Rowat

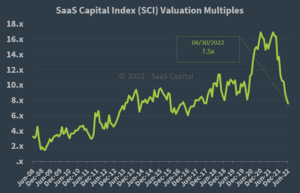

(updated July 9, 2022) When an exit is on the horizon, tech entrepreneurs need to come up with a way to value their company. Software as a Service (SaaS) companies are almost always valued using a Revenue Multiple. This is described in the companion article: How to Value a SaaS Company. SaaS company valuation starts with the current average multiple for SaaS public co...

Valuation

BY David Rowat

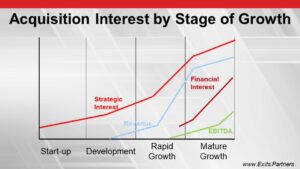

Who Buys Technology Companies and When? Unless you plan to build a company over several decades, you should plan how your company will eventually exit. If you are not planning to take your company public, then you need to look for another company that will acquire you. There are many types of acquirers for technology companies: companies of all sizes (not just the big ones); private equity (PE) and similar funds; fa...

Valuation

BY Basil Peters

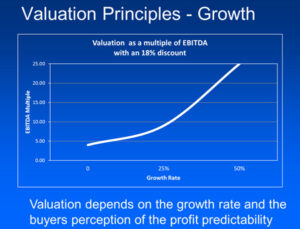

Valuing a tech company today has to be done much differently than five or ten years ago. In the old days (like 5 or 10 years ago) tech companies were more often valued using old economy methods. These were usually multiples of key financial metrics like profit, revenue and growth rate. This article was written by our Emeritus Founder almost a decade ago. It's a good description of how tech company v...