Author: David Rowat

Exits Talk

BY David Rowat

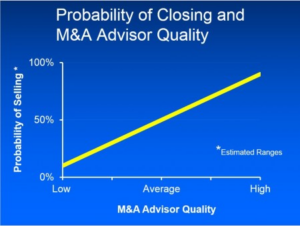

Directors love to get involved in the exit. it's the most fun part of working with a tech company and you might walk home with a big cheque. But Directors need to separate their roles as Directors and Investors. This paper describes how the Board of Directors of a technology company can exercise its fiduciary duty to supervise the work of management and its M&A advisors without becoming entangled in the process. Thi...

Exits Talk

BY David Rowat

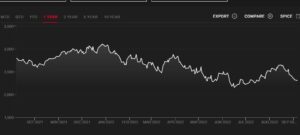

Before the correction, the stock markets in general, and technology and software in particular, had a multi-year run never seen before. The sudden reappearance of inflation and the rise in interest rates to combat it caused a correction in late 2021. There has been a lukewarm rebound recently but few are convinced that the correction is over. Many are nervous that there is more unwelcome news to come. So how has technology fared during these ...

Exits Talk

BY David Rowat

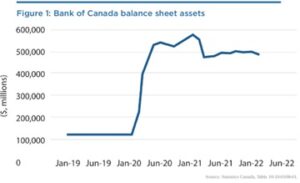

When financial markets decline suddenly, everyone becomes an economist explaining what is happening and why this time it is different than all the downturns that came before it. The downturn of 2022 may turn out to be a normal market correction in one of the most sustained financial bull markets in a century. But it could also be only the start of a prolonged term of financial setbacks that has been creeping up on us for years. The pr...

Exits Preparation

BY David Rowat

If you are a tech entrepreneur looking to sell your company, you want to see this video. It explains how to build a Financial Model that shortens the exhausting diligence process in two ways: first, it gathers all the historical, budget and future financial projections in one comprehensive Excel model, and second, it calculates the Normalized EBITDA used to value your company.Follow the process explained in the vi...

Exits Talk

BY David Rowat

M&A Fee Data Used to be Scarce: The size and terms of fees that M&A advisors charge for selling a company has been a hot topic in the tech industry for decades. Until the decade of 2010, data was scarce, and largely unpublished. M&A advisors would furtively gather in dark corners at finance conferences to discuss fees, but they were guarding information more than sharing it. The lack of transparency led to wide disparities in M&...

Valuation

BY David Rowat

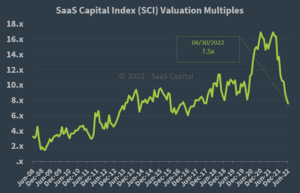

(updated July 9, 2022) When an exit is on the horizon, tech entrepreneurs need to come up with a way to value their company. Software as a Service (SaaS) companies are almost always valued using a Revenue Multiple. This is described in the companion article: How to Value a SaaS Company. SaaS company valuation starts with the current average multiple for SaaS public co...

Valuation

BY David Rowat

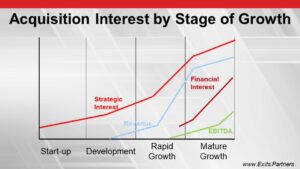

Who Buys Technology Companies and When? Unless you plan to build a company over several decades, you should plan how your company will eventually exit. If you are not planning to take your company public, then you need to look for another company that will acquire you. There are many types of acquirers for technology companies: companies of all sizes (not just the big ones); private equity (PE) and similar funds; fa...

Exits Strategy

BY David Rowat

In this fourth episode of the five-part series on Exits Strategies, a group of panelists answer several questions arising from Basil Peters’ first three presentations. The new Exit Strategies workshop was first presented at the Golden Triangle Angel Network in Waterloo, Ontario on May 8, 2015.

Exits Preparation

BY David Rowat

Minimize Stress and Maximize the Sale Price by Starting Early To sell your tech company for the most money with a minimum of stress means starting early - months before you start the exit process. Most of the work involves creating and assembling hordes of documents, which can be pretty boring. For that reason, it’s helpful to hire an introverted perfectionist a few months ahead of the planned exit who will leave ...

Exits Preparation

BY David Rowat

Ever heard this advice: “Just run the business well, and the exit will take care of itself”? Nothing could be further from the truth. Many businesses sold based on this type of foolish thinking probably caused their technology entrepreneurs to leave billions of dollars on the table. Many entrepreneurs had worked for years building their companies, not realizing that more value is created at the exit than at any other time. To maximize the se...