Author: David Rowat

Exits Talk

BY David Rowat

WHAT TECH FOUNDERS NEED TO KNOW ABOUT FINANCE HOW TO AVOID HIDDEN PITFALLS AND MAXIMIZE OPPORTUNITIES: NEW FINANCE BOOK EXPLAINS THE COMPLEXITY OF THE TECH FINANCE ECOSYSTEM VANCOUVER, BC, November 21, 2024 - A new finance book released today by

Exits Talk

BY David Rowat

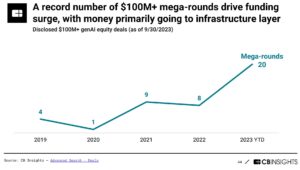

Introduction We have a new boom in tech: Generative Artificial Intelligence, or GenAI. It is a game-changer for entrepreneurs, exits and valuations. GenAI is blowing away all the pessimism clouding the tech industry today. Its rate of adoption is faster than any new technology preceding it. Figure 1 shows that ChatGPT, the first and largest GenAI application, reached 1 million users in 5 days.

Valuation

BY David Rowat

Note: there is a 16 minute video at the bottom of this post which summarizes the main points. UPDATE Previous versions of this article described a valuation process for SaaS companies that relied on the Annual Recurring Revenue (ARR) times a Revenue Multiple adjusted for the characteristics of the specific SaaS company. This current update in January 2024 improves on previous versions in two ways: first...

Valuation

BY David Rowat

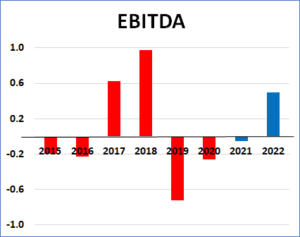

This article discusses the popular business valuation methodologies for valuing tech companies: Discounted Cash Flow EBITDA times Multiple Revenue times Multiple Discounted Cash Flow (DCF) approach DCF is the time-honoured approach which you can find in every textbook on valuation. It is the most credible for matur...

Exits Talk

BY David Rowat

There is a long-held belief that the financial markets for technology companies are highly volatile (as seen in the tech bubbles of 1999 and 2021 followed by the crashes of 2000 and 2022), whereas the healthcare financial markets are more stable. Strategic Exits Partners compared financial data from both sectors for Funding, Valuation and M&A. The results were surprising. The sectors follow the same patterns in some respects but not in others...

Exits Talk

BY David Rowat

Make no mistake, the tech industry is in a world of hurt right now. But there are signs that the worst might be behind us. 2022 and 1H2023 were terrible: The numbers and sentiments look pretty grim. Here are a few snippets: CB Insights charted the decline in tech valuations by stage of development from Q1 2022 to Q1 2023. It’s heart-stopping. See Table 1.

Exits Talk

BY David Rowat

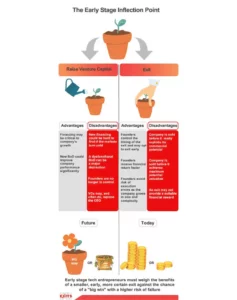

This is the complete graphic for the Early Stage Inflection Point article directly below. ...

Exits Talk

BY David Rowat

Early-stage tech companies can succeed for a period of time driven by the talents of the founders and small investments from family, friends and angel investors. At some point, however, the company grows to a size where management processes must become more formalized and many decisions will need to be delegated to avoid the chaos created by a small group of founders making all of the decisions. What got them to this point won’t get them to the ...

Uncategorized

BY David Rowat

Strategic Exits is the leading M&A advisor for entrepreneurs in the tech industry. We design and execute optimum business exit strategies, putting more money into the pockets of founders and their angel investors. We only provide M&A advisory services on the sell side to technology companies. We focus on the tech industry because we were once founders and executives too. We have experienced the successes and challenges of tech busines...

Exits Talk

BY David Rowat

After the longest bull market on record – almost 14 years – the NASDAQ reversed course at the beginning of 2022 and continued to slide for months, losing about 33% of its peak value. The M&A market fared somewhat better: Global M&A was down 27% in the first half of 2022 compared to 2021 but was still better than the 2015-19 cycle. Private tech company valuations declined a little in the first half of 2022 then declined a lot in Q3. In t...