Author: Basil Peters

Exits Execution

BY Basil Peters

Exit Execution Workshop (Philadelphia) Part 8: Maximizing the sale price This is the eighth in a series of eight posts on Exits Execution – the Philadelphia Series. In the session that may be of the greatest interest to founders looking to sell their companies, Basil discuses several techniques for increasing the sales price. The Exit Execution series follows the Exit Preparation presentation and Exit Strategies - The Waterloo Series available...

Exits Strategy

BY Basil Peters

In this fifth and final presentation, Basil discusses some of the risks of delaying the exit. Many founders feel optimistic about their progress and reason that they can delay the exit and manage the company to grow and achieve a higher valuation before exiting. This can be a dangerous strategy. It could result in a lower exit valuation or a failed exit altogether. This Exit Strategies workshop was first presented at the Golden Triangle Angel Ne...

Valuation

BY Basil Peters

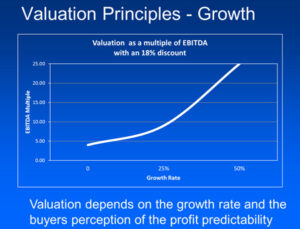

Valuing a tech company today has to be done much differently than five or ten years ago. In the old days (like 5 or 10 years ago) tech companies were more often valued using old economy methods. These were usually multiples of key financial metrics like profit, revenue and growth rate. This article was written by our Emeritus Founder almost a decade ago. It's a good description of how tech company v...

Exits Talk

BY Basil Peters

This was a talk to several hundred M&A professionals at the Association of Mergers & Acquisitions Advisors annual conference. The organizers asked me to discuss ways to increase the final selling price and gave me this title to work with. Key Points: The first step: Hire a really good M&A Advisor – seriously Isn’t going “from 3x to 7x” the main reason to hire an M&A Advisor? Selling a ...

Exits Talk

BY Basil Peters

I'm convinced that only about 25% of saleable businesses end up having successful exits. Yes. I believe that about 75% of the time, when a company could have been successfully sold, the result was either a transaction at prices or terms below market - or even worse - no sale at all. Most of the time, it was preventable. The biggest reason this happens is simply due to a lack of knowledge. The Frustrating Lack of Data on ...

Exits Talk

BY Basil Peters

The effect of strategy on exit valuation is one of the most challenging concepts for investors and entrepreneurs to intuitively understand. I didn’t ‘get it’ until I was fifty. It’s not that I am slow to learn, it’s just that, like a lot of things in life, it takes a few dozen experiences before the lessons really sink in. When those experiences are about selling a business and each data point can take a year, it can take decades to accumula...

Exits Talk

BY Basil Peters

I started my first company, Nexus Engineering, when I was still a grad student. A little over ten years later, the board decided it was time to sell. The company was the second largest manufacturer of cable TV headends in the world. The number one and number three in our vertical were Fortune 500 companies. Our Exit Strategy Our exit strategy was to sell our company to a Fortune 500 company in the defense business. At that time the...