Exits Talk

Exits Talk

BY David Rowat

M&A Fee Data Used to be Scarce: The size and terms of fees that M&A advisors charge for selling a company has been a hot topic in the tech industry for decades. Until the decade of 2010, data was scarce, and largely unpublished. M&A advisors would furtively gather in dark corners at finance conferences to discuss fees, but they were guarding information more than sharing it. The lack of transparency led to wide disparities in M&...

Exits Talk

BY David Rowat

Fully-Remote Companies Means More than Working From Home During the pandemic, we heard plenty of discussion about remote work, why employees love it, why companies are fighting it, and why we should expect to see hybrid in-office/at-home work styles. It may take some time to work out the bugs, but it is clear that remote work in some form will become a part of the work plan. There was occasional mention of how businesses ...

Exits Talk

BY David Rowat

July 11, 2020 Virtual Companies Sell for More Money (and the Founders Keep More of It) Online presentation to the Keiretsu Forum Northwest Chapter June 16, 2020. Virtual companies (where there is no physical head office and everyone works online) are worth more money when ...

Exits Talk

BY David Rowat

This post is based on the presentation David W. Rowat gave on January 23, 2021 to the Sauder School of Business entrepreneurial program at The University of British Columbia, affiliated with Creative Destruction Labs. As the Pandemic Subsides, the Financial Markets Continue Their Exuberance

Exits Talk

BY David Rowat

Presentation to the Entrepreneurship and Innovation class at the University of British Columbia Sauder School of Business. The class is associated with Creative Destruction Lab-Vancouver. Creative Destruction Lab delivers a program for select technology and science based companies with massive scale potential. The goal of Creative Destruction Labs is...

Exits Talk

BY David Rowat

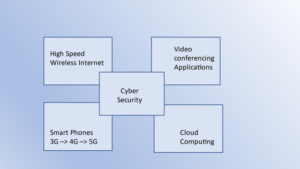

First published January, 2020. Technical advances have recently collided to allow these agile startups to disrupt established businesses. At Strategic Exits, we noticed a few years ago that more technology companies were starting up, growing and exiting without a physical office. These virtual (“all-remote” or “fully-remote”) companies exist only online. All employees work remotely using voice, text, email, video and doc...

Exits Talk

BY Basil Peters

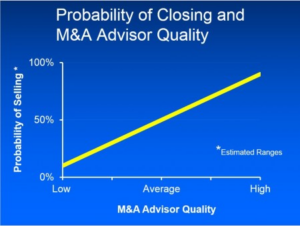

This was a talk to several hundred M&A professionals at the Association of Mergers & Acquisitions Advisors annual conference. The organizers asked me to discuss ways to increase the final selling price and gave me this title to work with. Key Points: The first step: Hire a really good M&A Advisor – seriously Isn’t going “from 3x to 7x” the main reason to hire an M&A Advisor? Selling a ...

Exits Talk

BY Basil Peters

I'm convinced that only about 25% of saleable businesses end up having successful exits. Yes. I believe that about 75% of the time, when a company could have been successfully sold, the result was either a transaction at prices or terms below market - or even worse - no sale at all. Most of the time, it was preventable. The biggest reason this happens is simply due to a lack of knowledge. The Frustrating Lack of Data on ...

Exits Talk

BY Basil Peters

The effect of strategy on exit valuation is one of the most challenging concepts for investors and entrepreneurs to intuitively understand. I didn’t ‘get it’ until I was fifty. It’s not that I am slow to learn, it’s just that, like a lot of things in life, it takes a few dozen experiences before the lessons really sink in. When those experiences are about selling a business and each data point can take a year, it can take decades to accumula...

Exits Talk

BY Basil Peters

I started my first company, Nexus Engineering, when I was still a grad student. A little over ten years later, the board decided it was time to sell. The company was the second largest manufacturer of cable TV headends in the world. The number one and number three in our vertical were Fortune 500 companies. Our Exit Strategy Our exit strategy was to sell our company to a Fortune 500 company in the defense business. At that time the...