Exits Talk

Exits Talk

BY David Rowat

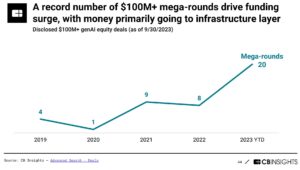

Introduction We have a new boom in tech: Generative Artificial Intelligence, or GenAI. It is a game-changer for entrepreneurs, exits and valuations. GenAI is blowing away all the pessimism clouding the tech industry today. Its rate of adoption is faster than any new technology preceding it. Figure 1 shows that ChatGPT, the first and largest GenAI application, reached 1 million users in 5 days.

Exits Talk

BY David Rowat

There is a long-held belief that the financial markets for technology companies are highly volatile (as seen in the tech bubbles of 1999 and 2021 followed by the crashes of 2000 and 2022), whereas the healthcare financial markets are more stable. Strategic Exits Partners compared financial data from both sectors for Funding, Valuation and M&A. The results were surprising. The sectors follow the same patterns in some respects but not in others...

Exits Talk

BY David Rowat

Make no mistake, the tech industry is in a world of hurt right now. But there are signs that the worst might be behind us. 2022 and 1H2023 were terrible: The numbers and sentiments look pretty grim. Here are a few snippets: CB Insights charted the decline in tech valuations by stage of development from Q1 2022 to Q1 2023. It’s heart-stopping. See Table 1.

Exits Talk

BY David Rowat

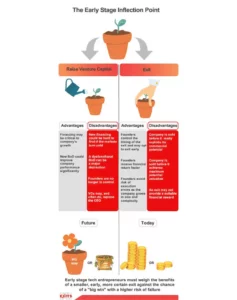

This is the complete graphic for the Early Stage Inflection Point article directly below. ...

Exits Talk

BY David Rowat

Early-stage tech companies can succeed for a period of time driven by the talents of the founders and small investments from family, friends and angel investors. At some point, however, the company grows to a size where management processes must become more formalized and many decisions will need to be delegated to avoid the chaos created by a small group of founders making all of the decisions. What got them to this point won’t get them to the ...

Exits Talk

BY David Rowat

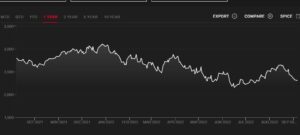

After the longest bull market on record – almost 14 years – the NASDAQ reversed course at the beginning of 2022 and continued to slide for months, losing about 33% of its peak value. The M&A market fared somewhat better: Global M&A was down 27% in the first half of 2022 compared to 2021 but was still better than the 2015-19 cycle. Private tech company valuations declined a little in the first half of 2022 then declined a lot in Q3. In t...

Exits Talk

BY David Rowat

I was disappointed to read in a recent column by Gus Carlson in the Globe & Mail https://www.theglobeandmail.com/business/commentary/article-recession-remote-workers-layoffs/ that Apple, Tesla and Goldman Sachs are a few of the many large companies that are using the impending recession to leverage their mobile workers back into the office.�...

Exits Talk

BY David Rowat

Directors love to get involved in the exit. it's the most fun part of working with a tech company and you might walk home with a big cheque. But Directors need to separate their roles as Directors and Investors. This paper describes how the Board of Directors of a technology company can exercise its fiduciary duty to supervise the work of management and its M&A advisors without becoming entangled in the process. Thi...

Exits Talk

BY David Rowat

Before the correction, the stock markets in general, and technology and software in particular, had a multi-year run never seen before. The sudden reappearance of inflation and the rise in interest rates to combat it caused a correction in late 2021. There has been a lukewarm rebound recently but few are convinced that the correction is over. Many are nervous that there is more unwelcome news to come. So how has technology fared during these ...

Exits Talk

BY David Rowat

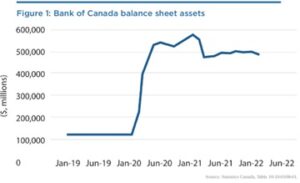

When financial markets decline suddenly, everyone becomes an economist explaining what is happening and why this time it is different than all the downturns that came before it. The downturn of 2022 may turn out to be a normal market correction in one of the most sustained financial bull markets in a century. But it could also be only the start of a prolonged term of financial setbacks that has been creeping up on us for years. The pr...